Archive for the ‘business’ Category

2 in 1 la CME

luni, septembrie 16th, 2013Pe locul lasat liber de Adrian Sarbu, boardul CME a numit doi CEO, Christoph Mainusch, ex RTL si Michael Del Nin, venit de la Time Warner, membru in boardul CME.

Robert Berza, ex New Media manager CME, i-a caracterizat pe cei doi intr-un tweet pe care-l gasiti mai jos:

CME numeste drept co-CEO un baiat tare destept de la Time Warner si un om cu experienta la RTL. #safiebine http://t.co/llQBq6yRkB

— Robert Berza (@robertberza) September 15, 2013

5 ani de criza

duminică, septembrie 15th, 2013M.Incubator, one week later

miercuri, septembrie 4th, 2013– Aproape 100 de proiecte/idei inscrise pana acum

– Trimitem mailurile de raspuns

– Incepem intalnirile cu proiectele selectate

Microsoft cumpara divizia de mobile Nokia

marți, septembrie 3rd, 2013Intr-un comunicat sec de acum cateva minute (incredibil cum, pe fondul retragerii lui Ballmer, stirea nu a rasuflat) Microsoft a anuntat ca a achizitionat intr-o tranzactie 100% cash divizia de Devices & Services de la Nokia. Microsoft va plati 7.2 miliarde USD, suma ce include si preluarea tuturor patentelor aferente. Huge.

„You. Will. Not. Fail.”

duminică, septembrie 1st, 2013Whatever investors say, the truth is you win by having a great vision and have the right personal qualities to make it win. Intelligence, drive, curiosity, flexibility, salesmanship, doggedness, all are important qualities. You have to care that people like you, but at the same time, you’ll piss a lot of people off, and that can’t stop you. Most important, you have to be unable to visualize failure. There’s a lot of bullshit floating around these days how failure is good. It’s not good. If you’re the kind of person who people should invest in, failure should not be a possibility. Even if they fire you, you won’t leave. Even if there’s no money, you won’t quit. If you have to go to board meetings alone, so be it. You. Will. Not. Fail.

Probabil cea mai realista analiza despre retragerea lui Ballmer*

marți, august 27th, 2013What really causes a company to fail is disruption. The business model around which all products, customers and priorities are built; the culture, the skills and “DNA” of the company; is vulnerable. This vulnerability is why companies have considerably shorter lifespans than the people who work there. They are one of the most fragile of organisms: high infant mortality, with short, unpredictable lives.

Microsoft ascended because it disrupted an incumbent (or two) and is descending because it’s being disrupted by an entrant (or two). The Innovator’s Dilemma is very clear on the causes of failure: To succeed with a new business model, Microsoft would have had to destroy (by competition) its core business. Doing that would, of course, have gotten Ballmer fired even faster.

Steve Ballmer’s only failing was delivering sustaining growth (from $20 to over $70 billion in sales.) He did exactly what all managers are incentivized to do and avoided all the wasteful cannibalization for which they are punished.

Steve Ballmer will not be remembered as favorably as the man who created Microsoft. But at least he won’t be remembered as the fool who killed it. That epitaph is reserved for his successor.

E diferenta dintre a spune, „da, trebuie sa facem/sa fim in search/mobile” si „da, trebuie sa facem seach/mobile, punem cei mai buni oameni din companie/piata sa se ocupe de asta si le dam toate resursele de care au nevoie chiar daca afectam produsele care acum genereaza profitul”.

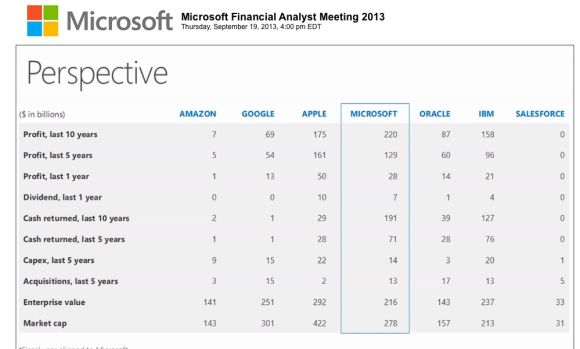

Altfel, as spune ca azi Microsoft pare ca se afla intr-o pozitie ceva mai buna decat Apple, dpdv al felului mai echilibrat in care si-a diversificat produsele/sursele de venit/zone de crestere, dar mult in urma Google (Microsoft opereaza pe cateva piete, Business division/Servers/chiar si Windows unde concurenta musca mai greu/deloc/ (sau piata scade mai greu) si intr-un ritm mai lent decat musca Android-ul/Samsung/restul din pietele iPhone/iPad, asta in timp ce Google nu are nici un fel de competitor pe zona de search/advertising si isi imparte mobile-ul/tableta cu Apple/Samsung chiar daca nu castiga direct). Mai pe scurt, daca nici una din companii nu schimba nimic, Microsoft cred ca ar avea parte de o „moarte” mai lenta decat ar putea avea parte Apple.

De aici Steve Ballmer and The Innovator’s Curse

* – probabil cea mai realista citita de mine, pana acum.

M.Incubator.ro

luni, august 26th, 2013Lansat astazi, Mincubator.ro = incubatorul Mediafax Group sau posibilitatea de a deveni colegi :)

Ce oferim:

– Sediu

– Marketing

– Servere/hosting/IT

– Research

– Bani (pentru proiecte care au deja „tractiune”)

– Consultanta

Ce cautam:

– Servicii (aici intra si partea de mobile/aplicatii)

– E-Commerce

– Proiecte de continut original

Din tot ce oferim, cel mai important este, cred eu, experienta/expertiza echipei M.ro si felul in care proiectele vor beneficia de ea.

Va mai recomand sa cititi sectiunea FAQ de unde am scos doua intrebari:

1.

Ce inseamna procent minoritar?

Vorbim de un procent minoritar ce poate varia de la 5% pana la 25%. In functie de resursele solicitate si de perspectivele de dezvoltare.

2.

Am un proiect care are nevoie de o finantare consistenta, pot aplica?

Da, poti aplica daca se incadreaza in genul de proiecte cautate de noi, daca nu vom putea acoperi singuri necesarul de finantare putem merge impreuna la alti investitori/fonduri de investitii.

Comunicatul de presa il gasiti aici.

Doua despre Ballmer/Microsoft

luni, august 26th, 20131. In 1999, ultimul an in care Bill Gates a fost CEO, Microsoft a avut 20 miliarde USD venituri, 7.8 miliarde USD profit, 17 miliarde USD cash in banca, iar capitalizarea firmei = 600 miliarde USD.

2. Anul trecut, anul 12 cu Ballmer CEO, Microsoft a avut venituri de 72 miliarde USD, profit de 23.5 miliarde USD, aproape 53 miliarde USD cash in banca, iar capitalizarea firmei = 200 miliarde USD.

Una despre Apple

duminică, august 18th, 2013Apple’s vertical integration leads to higher quality products but also fewer opportunities to charge tariffs. Unless you happen to have one of the greatest geniuses of the 20th century running the company, competing without tariffs means competing on a level playing, something Wall Street hates.

De aici